What Multi-Business Firms Can Learn From Private Equity Contributions to Portfolio Company Performance

Private equity firms have a long history of investing in and improving the performance of portfolio companies. In recent years, multi-business firms have increasingly turned to private equity for help in improving the performance of their own businesses. This trend is likely to continue in the coming years as private equity firms continue to develop new and innovative ways to help companies improve their performance.

There are a number of reasons why multi-business firms can benefit from working with private equity firms. First, private equity firms have a deep understanding of the factors that drive business performance. They have a team of experienced professionals who can help companies identify and address their key challenges. Second, private equity firms have a track record of success in improving the performance of portfolio companies. They have a proven ability to help companies grow sales, improve margins, and increase profitability. Third, private equity firms can provide funding to help companies invest in new growth initiatives. This can be a valuable resource for companies that are looking to expand their business or enter new markets.

5 out of 5

| Language | : | English |

| Paperback | : | 64 pages |

| Item Weight | : | 3.35 ounces |

| Dimensions | : | 5.83 x 0.15 x 8.27 inches |

| File size | : | 18648 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 307 pages |

There are a number of specific ways that private equity firms can help multi-business firms improve their performance. These include:

- Improving operational efficiency. Private equity firms can help companies improve their operational efficiency by identifying and eliminating waste. They can also help companies implement new processes and systems that can improve productivity.

- Growing sales. Private equity firms can help companies grow sales by developing new marketing strategies, expanding into new markets, and acquiring new customers. They can also help companies improve their customer service and salesforce effectiveness.

- Improving margins. Private equity firms can help companies improve their margins by reducing costs and increasing prices. They can also help companies negotiate better deals with suppliers and customers.

- Increasing profitability. Private equity firms can help companies increase their profitability by improving their operational efficiency, growing sales, and improving margins. They can also help companies make strategic acquisitions and divest non-core businesses.

Multi-business firms that are looking to improve their performance should consider working with a private equity firm. Private equity firms have a deep understanding of the factors that drive business performance, a track record of success in improving the performance of portfolio companies, and the ability to provide funding to help companies invest in new growth initiatives.

Case Study: How Private Equity Helped a Multi-Business Firm Improve Its Performance

One example of how private equity can help a multi-business firm improve its performance is the case of Newell Brands. Newell Brands is a global consumer products company with a portfolio of brands that includes Sharpie, Paper Mate, and Rubbermaid. In 2016, Newell Brands was struggling to grow sales and improve margins. The company's stock price had been declining for years, and the company was facing increasing competition from online retailers.

In 2017, Newell Brands hired a private equity firm to help improve its performance. The private equity firm worked with Newell Brands to develop a new strategic plan. The plan focused on improving operational efficiency, growing sales, and improving margins. The private equity firm also provided Newell Brands with funding to invest in new growth initiatives.

The new strategic plan has been a success. Newell Brands has improved its operational efficiency, grown sales, and improved margins. The company's stock price has also rebounded. In 2021, Newell Brands reported its highest sales and profits in the company's history.

The case of Newell Brands is just one example of how private equity can help a multi-business firm improve its performance. Private equity firms have a deep understanding of the factors that drive business performance, a track record of success in improving the performance of portfolio companies, and the ability to provide funding to help companies invest in new growth initiatives. Multi-business firms that are looking to improve their performance should consider working with a private equity firm.

Private equity firms can be a valuable resource for multi-business firms that are looking to improve their performance. Private equity firms have a deep understanding of the factors that drive business performance, a track record of success in improving the performance of portfolio companies, and the ability to provide funding to help companies invest in new growth initiatives. Multi-business firms that are looking to improve their performance should consider working with a private equity firm.

Here are some additional resources that you may find helpful:

- Bain & Company: Private Equity Performance Improvement

- McKinsey & Company: How Private Equity Creates Value

- Boston Consulting Group: Private Equity & Principal Investors

5 out of 5

| Language | : | English |

| Paperback | : | 64 pages |

| Item Weight | : | 3.35 ounces |

| Dimensions | : | 5.83 x 0.15 x 8.27 inches |

| File size | : | 18648 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 307 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Novel

Novel Page

Page Text

Text Library

Library E-book

E-book Newspaper

Newspaper Paragraph

Paragraph Shelf

Shelf Foreword

Foreword Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Tome

Tome Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Character

Character Resolution

Resolution Librarian

Librarian Catalog

Catalog Borrowing

Borrowing Stacks

Stacks Study

Study Research

Research Lending

Lending Academic

Academic Journals

Journals Reading Room

Reading Room Special Collections

Special Collections Interlibrary

Interlibrary Literacy

Literacy Study Group

Study Group Storytelling

Storytelling Reading List

Reading List Theory

Theory Textbooks

Textbooks Paul S Adler

Paul S Adler H R Woudhuysen

H R Woudhuysen Frank Sinatra

Frank Sinatra Carol J Perry

Carol J Perry David Mark Brown

David Mark Brown Katia Luz

Katia Luz Adrianne Surian

Adrianne Surian Rabindranath Tagore

Rabindranath TagoreStan Bendis Kutcher

Kevin Bruyneel

Kevin Bruyneel Dawna Markova

Dawna Markova Ken Haigh

Ken Haigh Ethem Alpaydin

Ethem Alpaydin Margaret Stump

Margaret Stump Rj Scott

Rj Scott Barry Louis Polisar

Barry Louis Polisar Jonathan W Emord

Jonathan W Emord P M Rao

P M Rao Mitch Levin

Mitch Levin Bruce Crowther

Bruce Crowther

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Joe SimmonsThe Permanent Floating Voluntary Society 1966: A Countercultural Experiment...

Joe SimmonsThe Permanent Floating Voluntary Society 1966: A Countercultural Experiment... Felipe BlairFollow ·19.7k

Felipe BlairFollow ·19.7k Kazuo IshiguroFollow ·15.6k

Kazuo IshiguroFollow ·15.6k Greg FosterFollow ·11.1k

Greg FosterFollow ·11.1k Timothy WardFollow ·15.2k

Timothy WardFollow ·15.2k Allan JamesFollow ·7.2k

Allan JamesFollow ·7.2k Gordon CoxFollow ·19.9k

Gordon CoxFollow ·19.9k Leo TolstoyFollow ·8.6k

Leo TolstoyFollow ·8.6k Ethan GrayFollow ·4.9k

Ethan GrayFollow ·4.9k

Darius Cox

Darius CoxThe Gathering Pacific Storm: An Epic Struggle Between...

The Gathering...

Hugo Cox

Hugo CoxHow CIA-Contra Gangs and NGOs Manufacture, Mislabel, and...

In the annals of covert operations, the CIA's...

Finn Cox

Finn CoxDr. Brandt's Billionaires Club Series: The Ultimate...

A Journey into the Pinnacle of...

Isaac Asimov

Isaac AsimovCurrent Affairs Daily Digest 20180730 30th July 2024

National ...

Felix Carter

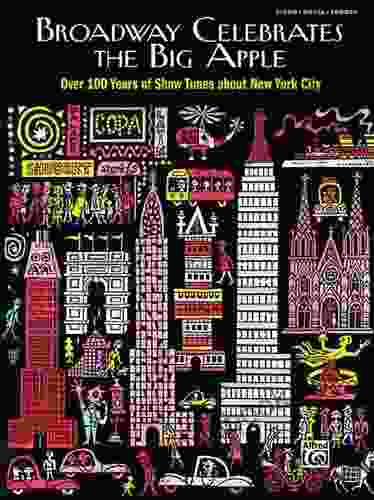

Felix CarterBroadway Celebrates The Big Apple Over 100 Years Of Show...

Broadway Celebrates the Big Apple: Over 100...

Beau Carter

Beau CarterThe Big Book of Flute Solos: A Comprehensive Collection...

If you're a flute player,...

5 out of 5

| Language | : | English |

| Paperback | : | 64 pages |

| Item Weight | : | 3.35 ounces |

| Dimensions | : | 5.83 x 0.15 x 8.27 inches |

| File size | : | 18648 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 307 pages |